Once you’ve signed your offer letter, you’ll be sent to Onboarding – our online system that includes all mandatory pre-employment paperwork specific to you and your summer work location. This is the first step towards a successful summer!

Q: Why do I have to complete this paperwork?

A: So you can come work at camp! You won’t be able to start working until all of your Onboarding paperwork is finished, so please complete the forms and tasks assigned to you carefully!

Q: I didn’t get an email with the login information. Help!

A: If it’s not yet May 1, don’t worry! We haven’t launched it yet.

If it’s after May 1, we launch team members in rolling waves. Please be sure to check your email’s Clutter/Junk filter settings and add the address Headfirst Camps @ icims “headfirstcamps+autoreply@agents.icims.com” to your Address Book if you suspect that emails may otherwise be flagged as spam. You will receive an email with your login username and an option to reset the password if needed. Please store these details in a safe place.

Q: My question isn’t answered here. Who can I contact?

You can reach out to the person you’ve been in contact directly, or submit your question to the Talent Helpline here. A staff member will be in touch ASAP!

To support all seasonal staff – Honor Roll, Summer Camps, and Professional Sports Camps – in completing their onboarding tasks and paperwork, we have scheduled Onboarding Help Sessions, or “Office Hours,” throughout the spring.

These are drop-in, as-needed sessions, so feel free to join for any questions if you have them!

Microsoft Teams links will be sent out in advance of each session.

2025 Session Dates & Times

- Tuesday, April 29 – 6-7 pm EST

- Wednesday, May 14 – 7-8 pm EST

- Tuesday, June 3 – 6-7 pm EST

Updated 11/13/2024

Q: What forms and information will I have to fill out?

A: Please see the list below for a summary of the details required. Almost all are provided digitally within the Onboarding portal. (Fingerprinting and notary must be done on paper and uploaded, as well as some required health documentation.)

FORMS ABOUT YOU

- Basic contact information, references, and certifications (if applicable)

- This lets us contact you, check references, and review any certifications required for your position (ie lifeguarding or CPR/First Aid).

- Headfirst Health Information Request

- This form gives us information in the event a health issue occurs for you – who to contact, allergies, medications, etc. It’s confidential unless needed in an emergency.

- Seasonal Team Confidentiality Agreement

- This form requires a signature noting your understanding that Headfirst content, information, resources, and trainings, etc. be kept confidential.

- Federal I9 Form

- This verifies your identity and authorizes you to work.

- Background Check Self-Disclosure Form

- This gives you an opportunity to self-disclose anything that may pop up in a background check.

PAYROLL

- Direct Deposit/Paycheck Information

- This form gives us the information on how to pay you! Make sure it’s correct!

- Tax Withholding Forms (state specific)

- This forms allows you to select which STATE taxes are taken out of your paycheck.

- Federal W4 Form

- This form allows you to select which FEDERAL taxes are taken out of your paycheck.

BACKGROUND CHECKS

There may be additional state-specific requirements based on licensing guidelines. Please see the Onboarding task instructions for more details.

- Child Protective Services Checks (state specific instructions)

- As a child programs provider, we are required to run a check through the child protective agency of the jurisdiction to confirm our staff are approved to work with children.

- Background/Fingerprint Checks (state specific instructions)

- This form provides information on how to get a background check and/or fingerprinting check done and depends on the state guidelines. It requires a visit to an authorized provider as per the instructions.

HEALTH DOCUMENTATION

- MASSACHUSETTS: Physical & Vaccination History

- Massachusetts requires a recent physical and complete vaccination history to be reviewed and approved prior to working at camp.

- VIRGINIA: TB Screening Request

- Virginia requires a clear tuberculosis check prior to working at camp. This can be done in two parts at a doctor’s office or CVS. It requires an initial visit and then a follow-up to read the results in person.

All newly hired or rehired team members are required to complete a background check authorization and a self-disclosure form as a part of pre-employment onboarding. All offers of employment are contingent upon the satisfactory outcome of this background investigation, and team members must successfully complete these requirements before starting work.

Please note: Depending on your work location’s jurisdiction, there may be additional tasks related to background checking, like submitting fingerprints.

Background Check Authorization

- An important component of your pre-employment onboarding is the completion of a background check authorization. To ensure the accuracy and security of our checks, we partner with a trusted pre-employment screening service provider.

- The background check authorization will be emailed to you at the same time you receive the email on accessing the onboarding portal (where the other paperwork lives).

- Your completed and authorized background check must be processed and cleared by our HR team before you are approved to go to site. Processing time varies by jurisdiction and additional time can be needed if a result is returned that requires further investigation or individual evaluation, so it is very important to authorize the check as quickly as possible.

Self-Disclosure Form

- In addition to your background check authorization, you will be required to complete a Self-Disclosure Form as part of your onboarding tasks. As with the background check authorization, it is important that you complete the Self-Disclosure form promptly, as any affirmative responses (or discrepancies between the background check results and your responses) can require further investigation or individual evaluation.

Confidentiality & Use of Background Investigation Information

- The information obtained through the background check and self-disclosure process will be treated confidentially and used only for purposes of determining suitability to work in the role for which you have been hired in accordance with Headfirst’s Background Investigation & Fitness to Work policy. This policy is available by contacting the Human Resources Department.

- If the background investigation results or the answers provided on the Self-Disclosure Form require further discussion, a designated HR representative will contact you directly as soon as possible

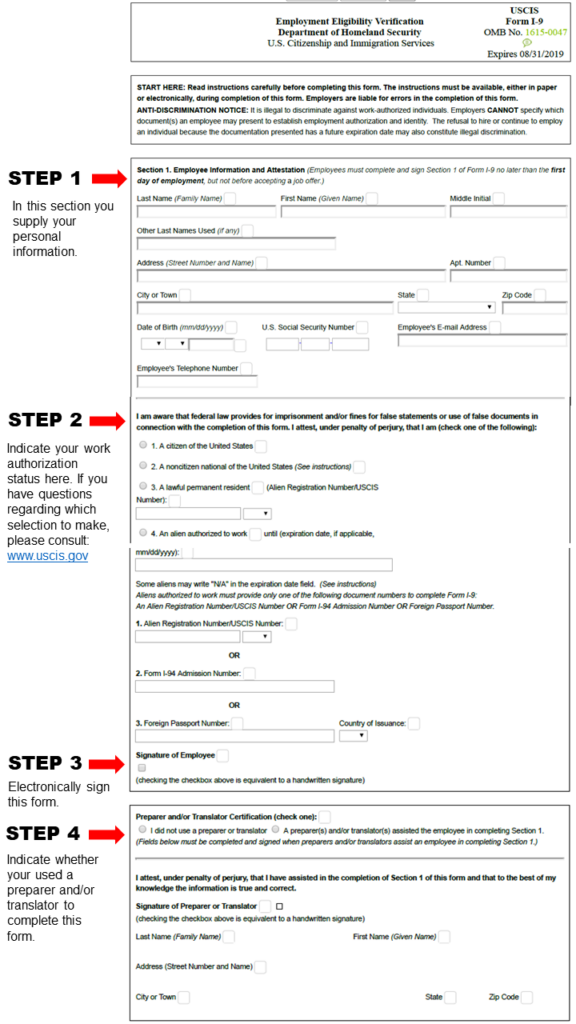

Q: What is the Federal I-9 Form?

A: Federal law requires employers to verify that new employees as well as reverify that returning employees are legally authorized to work in the United States. By completing the I-9 form, you provide Headfirst with the necessary information to confirm your employment eligibility.

The form is two parts – the information you complete, and then the identity document verification — this is where Headfirst staff will view your documents to prove your identity, therefore confirming the information.

Q: What are “I9 Identity Items” and when do I need to bring them?

A: The I9 identity items (or “acceptable documents” are the physical ID items that provide identification as well as confirm your eligibility to work in the United States.

You will need to bring the original identity items for our team to verify at in-person training, or your first day of employment onsite. Please do not upload or send a photo of them via email.

Valid identification items include:

- US Passport or Passport Card (original) OR

- Driver license with photo AND Social Security card (original) OR

- Driver license with photo AND birth certificate (original) OR

- For additional guidance and the full list of accepted documents, go here.

(You do NOT need to print a copy of the I9 form – “documents” refers to the physical identity items that show your identity.)

Q: What sections do I need to complete?

A: Please see below for a more detailed overview of the steps necessary to complete the form.

I-9 Form Instructions

As part of the onboarding process, you will need to complete important tax information in order to work with us. Please use the following notes and videos as a guide to complete the form, as we are unable to provide tax advice.

If you require a different tax form than the one supplied through onboarding, please reach out to our team at talent@headfirst.com.

W-4 Form (v2023)

1. Step 1 is for your personal information, including your name, address, filing status, and Social Security number.

2. If you have a more than one job or a spouse who works, you’ll complete step 2. The IRS notes that some taxpayers may be worried about disclosing additional jobs to their employer so there are multiple ways to calculate your withholdings for this section. Generally, there are three options, which “involve tradeoffs between accuracy, privacy, and ease of use,” according to the IRS.

For “maximum accuracy and privacy,” the IRS recommends using its Tax Withholding Estimator to determine the amount that should be withheld based on your income for one or more jobs. If you work as an independent contractor, you can choose to pay estimated quarterly taxes instead of having part of your paycheck withheld.

3. If you claim dependents and earn less than $200,000 as a single filer or $400,000 as a joint filer, you’ll follow the instructions in step 3. This is to determine credits you may be eligible for.

4. Step 4 is optional, but if you have interest, dividend, or retirement income or you plan to claim itemized deductions when you file your taxes, fill this out. Also, if you would like to withhold additional money from each paycheck in order to get a bigger refund next year, you can enter the dollar amount in this section.

Remember, though, that a tax refund means you aren’t getting all the money that’s rightfully yours throughout the year. In essence, you’re loaning the government money, interest-free. If you want to get as close to your true tax liability as possible, carefully and thoughtfully fill out — and check up on — your W-4.